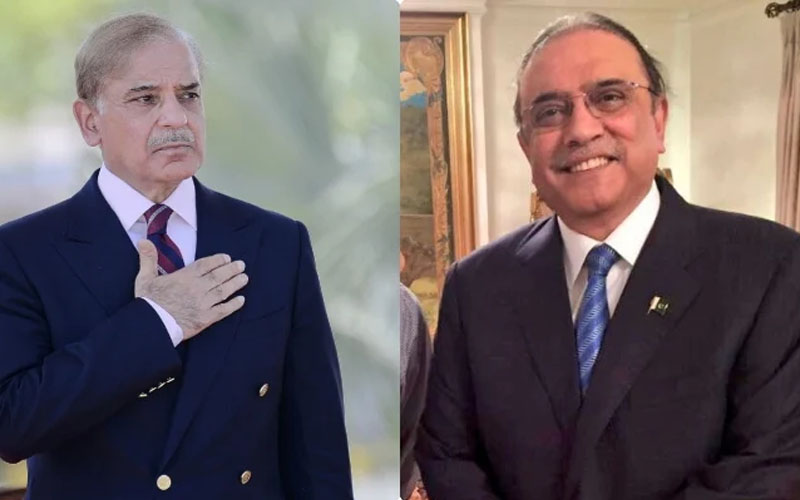

Prime Minister Shehbaz Sharif-led government on Thursday unveiled a five-year industrial policy targeting industrial growth, export enhancement, and financial relief for businesses.

Key measures include phased reduction of super tax and local levies, while IMF oversight remains a potential hurdle for immediate execution.

Under the new industrial policy, the super tax will be reduced from 29% to 26% in phases. This 3% reduction is expected to provide relief of Rs 270 billion to the industrial sector, easing the burden on medium and small-scale industries by Rs 110 billion.

Additionally, a 1% advance income tax for medium and small industries will be abolished. These measures are designed to improve liquidity and promote industrial expansion.

Support for exports and industrial revitalisation

The policy includes several initiatives aimed at boosting exports and reviving closed units:

-

Export tariffs will be reduced over the next five years.

-

Local taxes and withholding on imported inputs will be reduced to give exporters financial space.

-

A National Industrial Rehabilitation Commission will be formed to revive closed units, with commercial banks providing loans under State Bank directives.

-

Bank financing in the private sector is set to increase by 20%.

-

Full implementation of energy recovery policies and upgrading of electricity transmission and distribution systems is also planned.

Sources in the Ministry of Finance revealed that IMF opposition is the main obstacle to immediate implementation of the policy.

The IMF has specifically opposed the 3% super tax reduction and other tax exemptions, citing ongoing loan program obligations.

Officials say that if negotiations with the IMF are unsuccessful, full implementation of the industrial policy may be delayed until 2027.