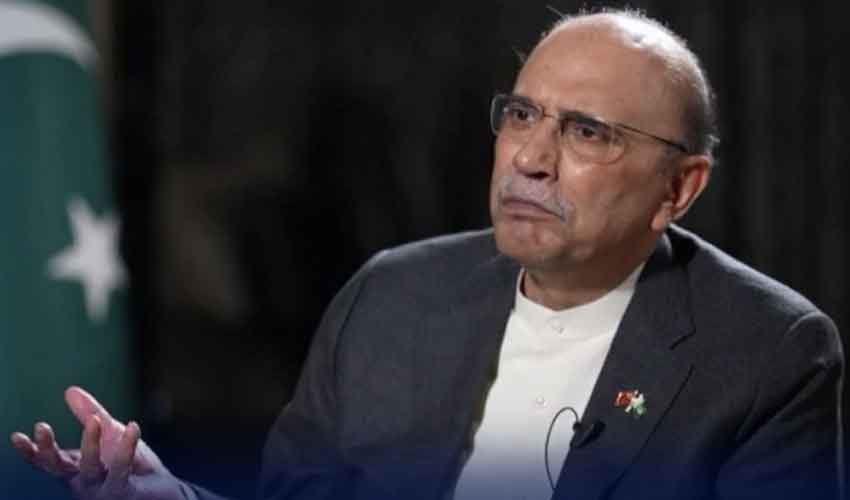

President Asif Ali Zardari has notified the formation of the 11th National Finance Commission (NFC) under Article 160 of the Constitution. Headed by Finance Minister Muhammad Aurangzeb, the nine-member commission includes provincial finance ministers and one expert from each province. Since the landmark 7th NFC Award in 2010, three commissions — the 8th (2015), 9th (2016), and 10th (2019) — were constituted, but all failed to reach a new consensus, leaving the old formula in force by default.

Each time, the federation pushed for a greater share to cover debt servicing, defense, and subsidies, while provinces resisted, insisting that after the 18th Amendment they needed more funds for health, education, and local development. Political polarization, frequent changes in finance ministers, and Pakistan’s persistently low tax-to-GDP ratio of around 11% further stalled progress.

Structural flaws in the formula — rewarding population size and poverty instead of performance — also discouraged reform. As a result, for 15 years, no new award has been agreed, and the recently constituted 11th NFC (2025) is another attempt to revisit this deadlock. On paper, this looks like a routine constitutional exercise. In reality, however, the 11th NFC has the potential to trigger one of the most contentious political debates in Pakistan today.

Approved in 2010, the 7th NFC Award was hailed as a “historic achievement” at that time. It broke away from the old tradition of dividing resources solely on population, introduced a multi-factor formula, and crucially raised the provinces’ share in federal tax revenues by 10% of the total. For the federation, that was a major concession; for provinces, it was a long-awaited victory.

The vertical distribution of the divisible pool was set at 57.5% for provinces and 42.5% for the federation. In horizontal distribution, the formula gave 82% weight to population, 10.3% to poverty/backwardness, 5% to revenue collection, and 2.7% to inverse population density. On that basis, Punjab receives about 51.74%, Sindh 24.55%, KP 14.62% (plus 1% for security), and Balochistan 9.09%.

But what was once celebrated is now increasingly seen as structurally flawed. The federal government is strapped for cash, unable to cover debt repayments, defense needs, or development expenditure. Critics argue that while provinces’ share increased, their responsibilities did not. Islamabad is left scrambling for resources, while provincial governments grow dependent on federal transfers without making serious efforts to expand their own tax bases.

The political challenge is equally daunting. PPP Chairman Bilawal Bhutto Zardari insists that provinces cannot be deprived of funds, especially after the 18th Amendment handed them more responsibilities. The PTI’s leadership in Khyber Pakhtunkhwa demands that FATA’s merger entitles the province to additional resources, a right they say has been denied. With all major political parties running provincial governments, expecting them to give up their share willingly seems unrealistic.

Yet, if Pakistan is serious about reform, the population-based formula must change. As it stands, 82% of the weight goes to population. What incentive does that give provinces to control their numbers? Planning Minister Ahsan Iqbal is right when he argues that provinces avoid population control precisely because having more people means greater monetary share. Interestingly, the KP government appears to support this rethink. Its finance minister has even said that both population and backwardness should be dis-incentivized.

In practice, provinces have contributed little. Pakistan’s tax-to-GDP ratio remains stuck around 11%, far below regional peers. Provinces collect less than 1% of GDP in taxes, while the FBR collects over 10%. The 7th Award promised that by 2015 the tax-to-GDP ratio would rise to 15%, with provinces contributing 2.5%. A decade later, nothing has changed

The same logic applies to the poverty/backwardness indicator, which currently carries a 10.3% weight in the NFC formula. If provinces are rewarded simply for being poor, what incentive do they have to actually reduce poverty? This system risks encouraging underperformance. Instead, the formula should be redesigned to reward progress—provinces that succeed in reducing poverty, improving health and education, or strengthening climate resilience should receive greater resources. The urgency of this reform is clear: according to the World Bank, Pakistan’s poverty rate was 36.8% in 2010, but by 2025 it has risen to 44.7%, highlighting how the existing system has failed to deliver meaningful change.

Then comes revenue collection, which accounts for a paltry 5%. In practice, provinces have contributed little. Pakistan’s tax-to-GDP ratio remains stuck around 11%, far below regional peers. Provinces collect less than 1% of GDP in taxes, while the FBR collects over 10%. The 7th Award promised that by 2015 the tax-to-GDP ratio would rise to 15%, with provinces contributing 2.5%. A decade later, nothing has changed. Without serious fiscal reforms, the NFC will remain a zero-sum game.

The 7th NFC was reached through consensus because Punjab and Sindh were willing to sacrifice for the sake of national harmony. But today’s political climate is harsher. Each party clings to its provincial turf. The center is broke. Provinces are complacent. And the economy is under siege.

The 11th NFC is not just about dividing money. It is about forcing Pakistan to confront uncomfortable truths: that population growth must be curbed, poverty cannot be treated as an entitlement, and provinces must raise their own revenues instead of relying on Islamabad’s dwindling resources.

Whether this commission succeeds—or collapses like its predecessors—will reveal whether Pakistan’s political leadership can rise above narrow interests for the sake of the federation. At stake is not just fiscal balance, but the survival of a functional state.

The author is an Islamabad-based journalist. He has been working in the media industry for the past 15 years and has served with some of Pakistan’s leading news organizations.