The National Assembly has approved the budget for the next financial year 2025-26.

The Finance Bill 2025 has been approved by a majority vote in the ongoing National Assembly session chaired by Speaker Sardar Ayaz Sadiq.

After the approval of the Finance Bill, the National Assembly session was adjourned until 11am tomorrow.

During the session, clause-wise approval was given by a majority vote, while all the opposition’s cut motions were rejected.

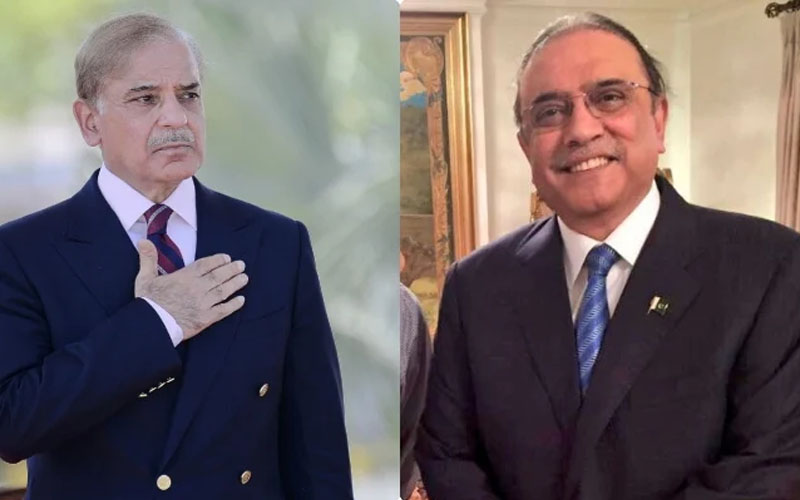

Earlier, a federal cabinet meeting was held under the chairmanship of Prime Minister Shehbaz Sharif, wherein the cabinet approved the Finance Bill 2025-26 with amendments.

Prime Minister Shehbaz Sharif was also present in the National Assembly at the time of clause-wise voting on the budget. An amendment to the Salaries and Allowances Act was presented in the National Assembly. Finance Minister Muhammad Aurangzeb expressed his support for the proposed amendment.

During the vote counting, Interior Minister Mohsin Naqvi approached Bilawal Bhutto Zardari’s seat, greeted him with a handshake, and engaged in a brief conversation. Throughout the voting process, the finance minister, interior minister, law minister, and Rana Sanaullah remained seated in the House.

It is important to note that only elected MNAs are eligible to cast votes.

Also approved was the Federal Board of Revenue's (FBR) tax revenue target of Rs14,131 billion for the upcoming fiscal year 2025–26. In addition, the target for non-tax revenue has been set at Rs5,147 billion.

Under the National Finance Commission (NFC) Award, the provinces will receive Rs8,206 billion from the divisible pool of revenues.

Major allocations:

-

Interest payments: Rs8,207 billion

-

Pensions: Rs1,055 billion

-

Defence: Rs2,550 billion

-

Salaries of government employees: Rs971 billion

-

Federal development budget: Rs1,000 billion

Key legislative reforms in Finance Bill 2025

Amendments to the Customs Act, 1969:

-

Approval has been granted for significant amendments to the Customs Act, 1969.

-

A cargo tracking system will be introduced to prevent smuggling. This system will electronically monitor the import, export, transit, and delivery of goods.

-

A new e-Bilty system will be implemented to digitize documentation related to the transportation of goods. Vehicles used for imports, exports, and deliveries will be linked to this digital platform.

-

Two new sections — 225 and 226 — have been added to the Customs Act.

-

Under Section 225, a Customs Command Fund will be established, financed through proceeds from the auction of confiscated smuggled goods.

-

The fund will be utilized for anti-smuggling operations, with oversight from the Ministry of Finance and the FBR.

-

The FBR will determine the rules, conditions, and restrictions for the use of the fund.

-

The Customs Board will be empowered to designate any customs checkpoint as a Digital Enforcement Station, and to issue the relevant rules and technical qualifications for enforcement staff through gazette notifications.

Sales tax fraud provisions strengthened

The Finance Bill also includes strict new measures and amendments related to sales tax fraud:

-

Individuals involved in issuing fake tax invoices, tampering with sales tax records, or destroying tax evidence will now be liable to arrest under the law.

-

Submitting false information in tax returns will also be considered a punishable offense.

-

However, arrest will only be allowed after three formal notices have been served to the concerned company officer.

-

In cases where the sales tax fraud exceeds Rs50 million, the individual may be arrested.

-

If there is a risk of escape abroad or attempt to destroy evidence, the individual may be detained immediately.

-

Arrests can only be made after obtaining approval from a committee consisting of Member Operations and Member Legal.

-

Anyone arrested for tax fraud must be presented before a magistrate within 24 hours.

-

Investigations into sales tax fraud will not be kept confidential to ensure transparency.

Other approvals by National Assembly

-

Amendments to the Islamabad Capital Territory Tax on Services Ordinance were passed by majority vote.

-

The finance minister’s proposed amendments to the Sales Tax Act, 1990 were also approved.

-

A proposed amendment to empower a committee — instead of tax commissioners — to authorize arrests in tax fraud cases was passed.

-

Under the new provision, arrests can be made only if the tax fraud exceeds Rs5 crore (Rs50 million).

-

The FBR will not have the authority to arrest during the investigation stage.

-

All amendments proposed by the opposition in the Sales Tax Act were rejected by a majority vote.