In a major shift aimed at providing relief to the salaried class, the federal government has revised the income tax structure in the new Budget 2025-26, reducing the tax rate from 2.5% to 1% for individuals earning between Rs600,000 and Rs1.2 million annually.

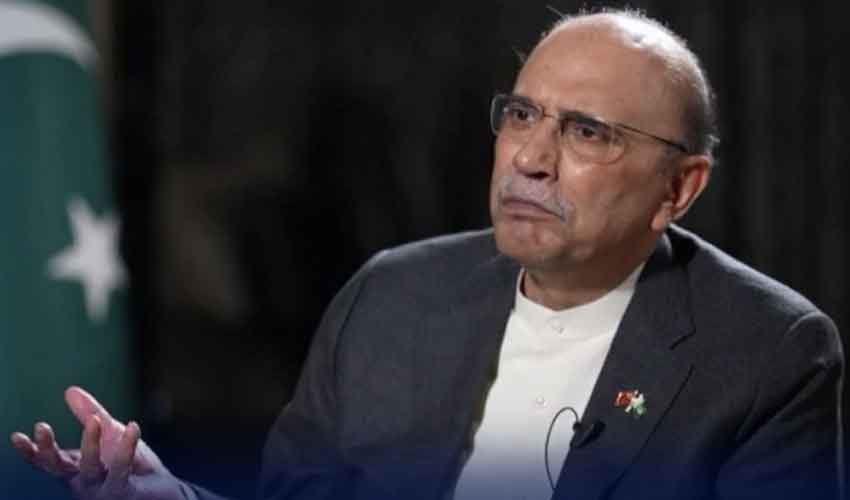

The decision, which comes after discussions between the government and the International Monetary Fund (IMF), was reportedly approved by the National Assembly Standing Committee on Finance, chaired by MNA Naveed Qamar. The IMF has expressed agreement with the revised lower tax slab.

Revised taxation for salaried individuals

Previously, the government had proposed a 2.5% tax on annual incomes between Rs600,000 and Rs1.2 million, a slab currently taxed at 5% in the outgoing fiscal year. However, amid criticism and concerns about the rising cost of living, the tax rate has now been reduced to 1%, offering significant relief to low and middle-income earners.

According to sources, the decision aims to ease the burden on salaried individuals, many of whom are already struggling with inflation and rising utility costs. The government had reduced the tax rate by increasing the tax relief for government employees from 6% to 10%.

New tax on high-value pensions approved

In a separate and more controversial move, the committee has approved a 5% income tax on annual pensions exceeding Rs10 million (Rs1 crore). The proposal was introduced by the Federal Board of Revenue (FBR) and supported by the committee chairman.

FBR Chairman Rashid Mehmood Langrial said no tax would be imposed on pensions up to Rs10 million per year. Naveed Qamar argued that pensions above Rs850,000 per month should not be tax-exempt.

"Pensions are taxed in many countries, including India," Langrial noted, adding that high pension earners must contribute to the national exchequer.

However, not all members agreed with the move. PTI leader Omar Ayub Khan criticized the FBR, saying, “If you're following global examples, then run the FBR according to international standards across the board.”

Committee member Muhammad Javed also raised objections, warning, “Today it's Rs10 million, tomorrow you'll start taxing Rs100,000 pensions too.” He further claimed that “nobody's pension, except judges, exceeds Rs10 million annually.”