The Senate Standing Committee on Finance, chaired by Senator Saleem Mandviwala, held a heated session on Tuesday, during which members expressed serious concerns over proposed taxes in the federal budget, including those on solar panels, and the leasing of aircraft to PIA.

A major point of contention was the implementation of General Sales Tax (GST) in the merged tribal areas (FATA and PATA). Senator Mohsin Aziz strongly opposed the inconsistent approach, stating, "If tax is to be imposed on FATA, then it should not be withdrawn."

He criticized the government’s lack of commitment, pointing out that a 12% tax had been recommended by a previous committee headed by Rana Sanaullah but was later reduced to 10% without explanation. Aziz further noted that while a similar tax was proposed this financial year, it was again scrapped before becoming part of the finance bill.

"People taunt us that this tax will be rolled back again," he remarked, urging the finance minister to give a firm guarantee to maintain the tax policy in the region. "Instead of reducing the tax on FATA, it should be increased further."

The FBR chairman revealed the full timeline of tax decisions relating to FATA and PATA, while also addressing other major fiscal matters. The committee also debated the sudden imposition of 18% sales tax on imported solar panels — a move that met widespread criticism.

Also Read: PPP won't support budget if 18% tax on solar panels imposed: Murad

Senator Saleem Mandviwala and other members demanded the immediate withdrawal of the solar tax, arguing it was discriminatory and potentially harmful to Pakistan’s renewable energy goals.

“Certain people imported solar equipment before the budget and are now poised to sell it at inflated rates,” said Senator Ahmed Khan, while Senator Zarqa Suhrawardy accused the tax had been imposed at the request of Independent Power Producers (IPPs).

“This is greenwashing,” she said. “On one hand, the government is imposing a carbon levy on petrol, and on the other, it’s taxing solar panels.” Several senators echoed the view that solar imports should remain tax-free to encourage clean energy adoption.

The meeting also addressed tax exemptions granted to Pakistan International Airlines (PIA) for leasing new aircraft. Mandviwala criticized the move as unfair unless extended to all airlines, warning that such selective taxation could face legal challenges. The FBR chairman defended the policy, stating that treating leased aircraft as capital goods benefits the airline's financial structure.

Additionally, committee members voiced opposition to taxes on small vehicles. “FATA and PATA are being granted tax relief, yet small car owners are being burdened,” said Senator Shibli Faraz. Senator Abdul Qadir suggested that vehicle taxes, like in FATA and PATA, should be phased in gradually.

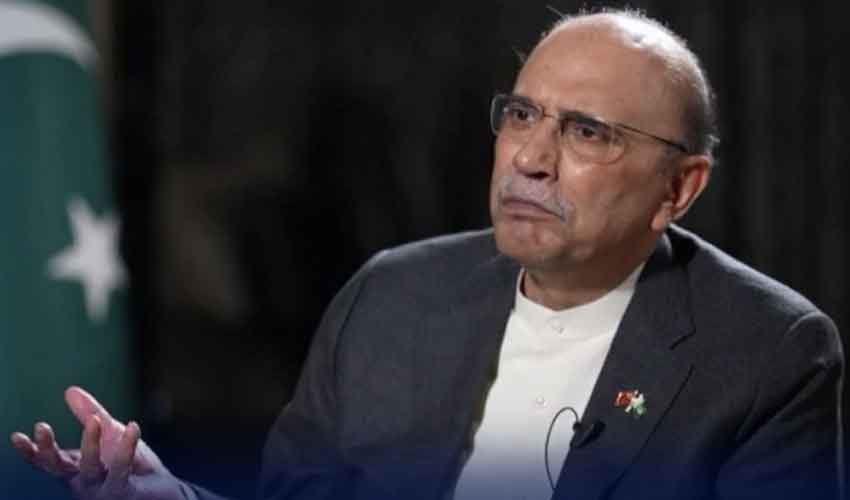

The session also included a briefing from Finance Minister Muhammad Aurangzeb, who outlined amendments to laws governing tax fraud arrests.

He announced that, as per the prime minister’s directions, four major changes had been introduced: the arrest authority will now rest with a committee of three Grade-21 officers, not a single commissioner; arrests will only occur if the committee is convinced; a minimum fraud threshold of Rs50 million has been set; and prior to any arrest, the accused will receive three separate notices.

Earlier, on June 14, Sindh CM Murad Ali Shah had warned that the Pakistan Peoples Party (PPP) would not support the federal budget if the 18% tax was imposed on solar panels, stating, “We strongly oppose the imposition of any such tax.”